Northern Pass Acknowledges “Back-up Plan”

- Tags:

- Northern Pass

As Eversource and Hydro-Quebec’s controversial Northern Pass transmission line proposal slides further behind schedule, a project with similar goals—importing more power from Quebec into the New England market—has leapfrogged Northern Pass in the effort to get permitted. This despite the fact that the project was proposed three years after Northern Pass went public in 2010. Both projects are now targeting 2019 as “in-service” dates.

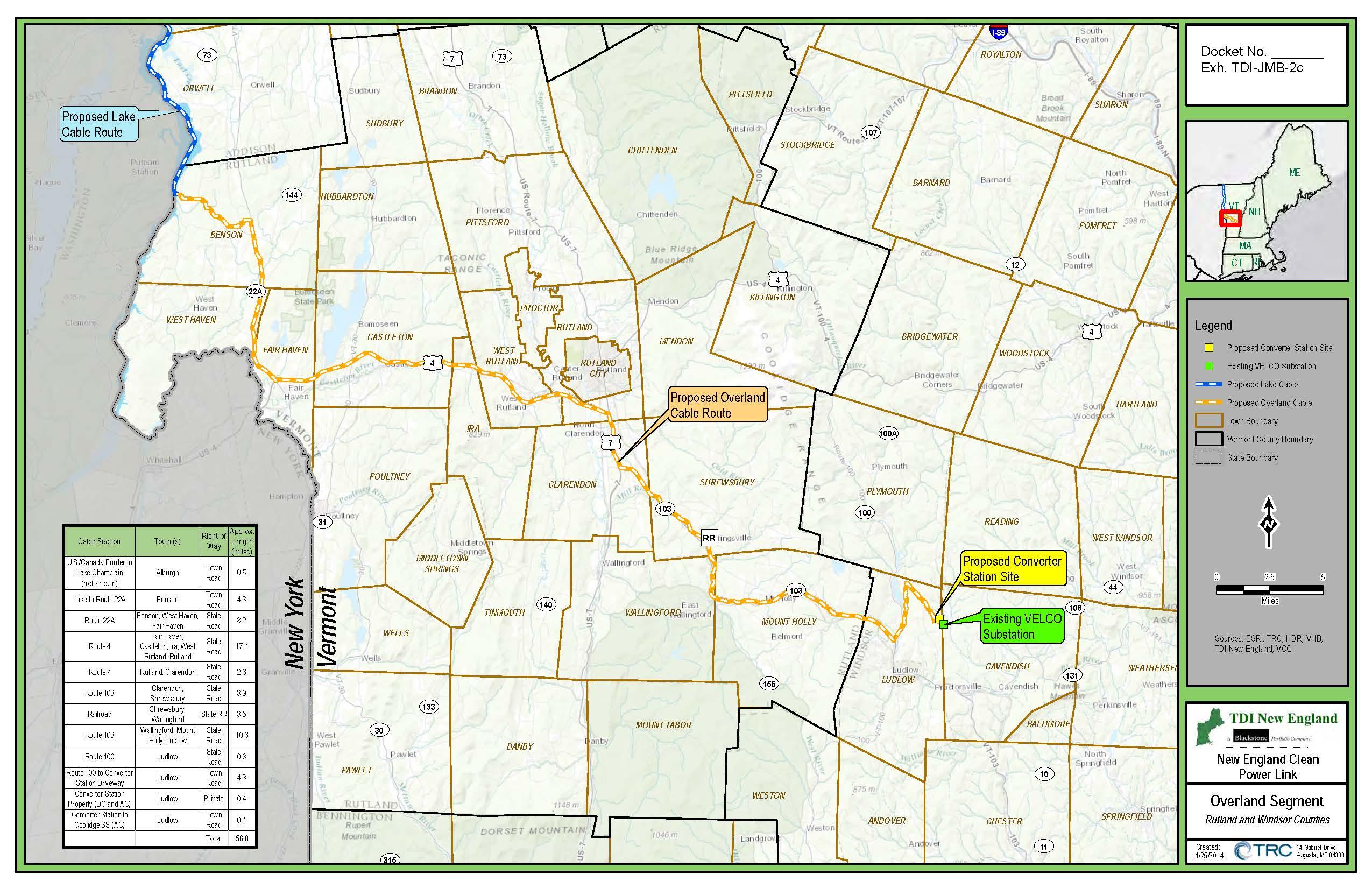

New England Clean Power Link (NECPL) is a 1,000 megawatt project proposed by TDI New England that, unlike Northern Pass, would use underground and underwater transmission cables through 154 miles of Vermont using newer HVDC Light cable technology. The 57 miles of underground cable would be along roads, with the balance of the line trenched along the bottom of Lake Champlain, with an estimated project cost of $1.2 billion. (Northern Pass, as proposed, would be a 1,200 megawatt line across 187-miles at cost of at least $1.4 billion.)

The U.S. Dept. of Energy (DOE) released the draft Environmental Impact Statement (EIS) for the NECPL in early June. Northern Pass had been telling its shareholders that its own draft EIS would be published earlier this year, but its release apparently has been delayed until later this summer.

NECPL is likely moving faster than Northern Pass in part because, as the draft EIS documents, there is comparatively little public opposition to the project as proposed. Burial of the line has made scenic impacts a non-issue, and the project developers seem to have avoided the private property rights concerns that have tripped up Northern Pass. Also, NECPL is a sister project of the Champlain Hudson Express, yet another 1,000 megawatt transmission line from TDI that will also be under Lake Champlain, the Hudson River, and underground along transportation corridors in New York.

The draft EIS for NECPL can be read online at http://necplinkeis.com/. Of particular interest to New Hampshire are some of the technical details of HVDC burial along roads (four feet down in a 12-foot ROW alongside roads where feasible, or underneath the road itself where necessary.) Northern Pass has argued its own limitations by suggesting they can’t bury a line for long distances along roads.

Northern Pass Back-Up Plan

That said, the speed with which a competitive project like NECPL is progressing along the permitting trail may have Northern Pass recognizing they will need to bury the New Hampshire line after all. In February, Northern Pass quietly submitted to ISO-NE a request for a 1,090 megawatt transmission line that mirrors the Northern Pass project. In response to inquiries at Eversource’s first-quarter earnings call in late April, executive Leon Olivier acknowledged the lower-capacity proposal, saying that it gives them “an option.”

“In the EIS they are studying a number of ranges around modifications to the project, different routes, and potentially some additional under-grounding,” Olivier said. “Basically this option to go with 1,090 [MW] would suggest using a different technology.”

Without more detail it’s hard to know exactly what this means. It appears that Eversource has done research into this new burial technology for possible application as an alternative in New Hampshire that it has chosen not to share publicly. Given that underground transmission proposals using new HVDC Light technology appear to be moving ahead, and given that an overhead Northern Pass faces significant permitting challenges at the state Site Evaluation Committee as well as potential other legal challenges, it should be no surprise that Eversource is looking more closely at a back-up plan. Nor should it be a surprise that Eversource would choose to avoid any public discussion of such an alternative, as such discussion might provide legitimacy to the idea that a completely buried line in New Hampshire is actually technically and financially viable.